Popular tax-smart gifts

Many people are increasingly choosing to give non-cash assets, so they can have a bigger impact at less cost to them.

Explore tax-smart gift options

Learn about gifts that maximize the impact of your support while providing tax benefits for you!

Stocks and securities

Many people love donating stock or mutual funds because it may help them avoid paying capital gains taxes.

Donor Advised Funds

Easily recommend grants to West Virginia State University Foundation for tax-efficient giving.

Cryptocurrency

Donate Bitcoin, Ethereum, and more to save on taxes and make a big impact.

Qualified Charitable Distributions

Use your IRA to make tax-free gifts that benefit you and our mission.

Real Estate

Donate real estate to make a lasting impact, unlocking the hidden potential of your property’s value.

Retained Life Estate

Secure your home’s future through a Retained Life Estate, ensuring support for us while residing in your property.

Planned giving helps make a difference for WVSU

A gift in your will creates a foundation for the future. Our work today is important, but it is equally, if not more important, to ensure that WVSU can continue to provide exceptional education and the resources to achieve anything we set our minds to.

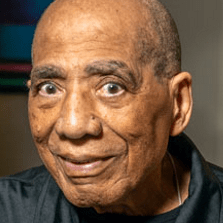

Fred D. Thomas Jr., ‘50

Fred D. Thomas Jr., ‘50 graduated from West Virginia State College with a bachelor’s degree in biology. After earning a graduate degree in education, he went on to serve as a middle school science teacher and curriculum coordinator for 35 years.

Read moreWe’re here to help you meet your goals!

Our team would be happy to speak with you in confidence about your giving goals, with no obligation.

Name: Phone: 304-766-3020

Email: Foundation@wvstateu.edu

Already included us in your estate plan? Let us know

More ways to make an impact

Gifts in a will or trust

Donations in your will or trust are (by far) the most popular type of planned gift. Learn more, or get help starting your will (for free!).

Beneficiary designations

Gifting assets not covered by your will — like 401(k) or IRA accounts — may help your heirs avoid unwanted taxes, even if you’re below the estate tax threshold.

Gifts that pay you back

Give assets while providing yourself or others with income for a period of time or distributions at a later date.